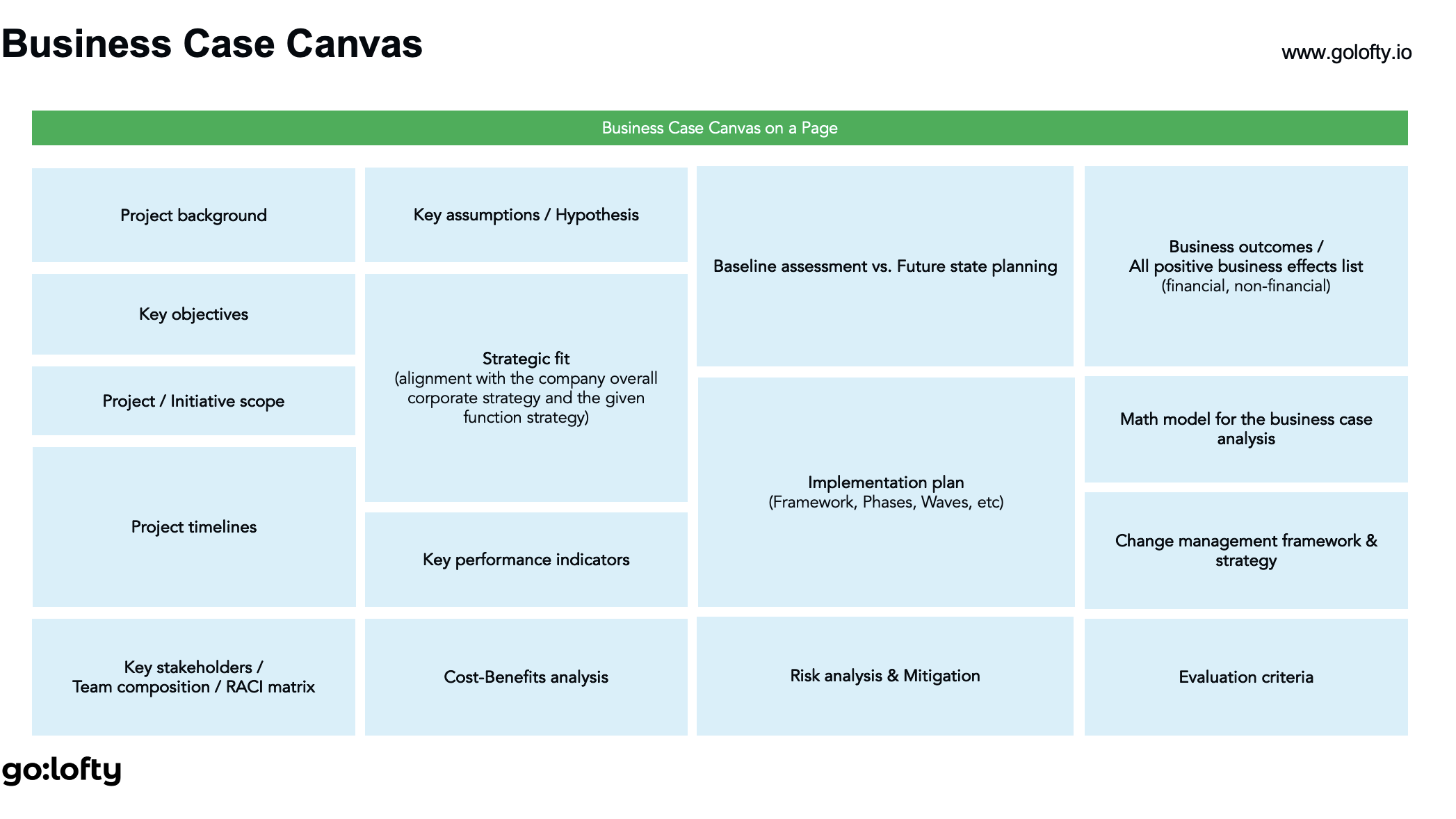

In the fast-paced world of business, presenting a well-constructed business case is critical for securing resources, aligning stakeholders, and driving projects forward. But crafting a business case is more than just outlining potential benefits—it’s about building a structured, data-driven argument that shows clear alignment with organizational goals and presents a credible plan for achieving them.

Here’s a step-by-step guide to building an effective business case that not only convinces but delivers results.

Step 1: Define the Purpose and Objectives

Every successful business case begins with a clear understanding of the purpose and objectives of the proposed project. Start by answering the question, “Why this project?” Consider both the immediate goals and how they align with broader business strategies. For example, if you’re proposing a new technology investment, outline the operational or strategic gaps it will address and its anticipated impact on productivity, revenue, or customer experience.

In this section, include:

- Objectives: Specific, measurable goals the project aims to achieve.

- Success Criteria: How you will evaluate the project’s success, linking each criterion to measurable outcomes.

Step 2: Identify Costs and Benefits

A business case should balance a realistic picture of costs with a clear analysis of anticipated benefits. This means accounting for implementation and maintenance costs while detailing the financial and operational gains expected from the project.

Use these categories to guide your analysis:

- Initial Costs: Include both direct (e.g., purchase price, training) and indirect costs (e.g., initial resource allocation).

- Recurrent Costs: Any ongoing expenses, such as maintenance, operational costs, and subscription fees.

- Expected Benefits: Detail both tangible benefits (e.g., increased sales, reduced expenses) and intangible gains (e.g., brand reputation, employee satisfaction).

By mapping out these costs and benefits in a clear grid, you provide decision-makers with a quick snapshot of the project’s financial viability. A transparent, straightforward breakdown of costs versus anticipated benefits builds trust and reduces pushback from stakeholders.

Step 3: Structure Benefits in a Hierarchical Model

To make the case more compelling, structure the benefits in a way that’s easy to understand and aligns with organizational goals. Breaking down benefits hierarchically allows you to demonstrate both the immediate and long-term effects of the project.

For example, you might structure the benefits as follows:

- Direct Financial Impact: Increased revenue, decreased operational costs.

- Operational Efficiency: Streamlined processes, time saved.

- Strategic Value: Strengthened market position, improved customer loyalty.

Using this hierarchy, you can visually map out how each benefit ties into broader organizational objectives. This hierarchy clarifies the chain of value and enables stakeholders to see the full scope of the project’s potential impact.

Step 4: Outline Conditions and Assumptions

No project is without risks and dependencies. Clearly identifying the conditions and assumptions behind your business case can help mitigate uncertainty and prepare stakeholders for potential challenges. These may include market conditions, resource availability, technology dependencies, or regulatory requirements.

Create a conditions diagram that outlines:

- Financial Conditions: Required budget approvals, financial risks.

- Operational Conditions: Availability of required resources, capacity for change.

- Behavioral Conditions: Stakeholder buy-in, alignment of project goals with team objectives.

By including these conditions, you can manage expectations and present a more resilient, realistic business case.

Step 5: Choose a Calculation Model

A well-developed business case will include a calculation model to demonstrate quantifiable benefits and return on investment (ROI). This model can vary in complexity depending on the audience and the scope of the project.

- Basic Calculation Models: Suitable for smaller projects where simplicity is key. This might include straightforward ROI calculations or cost-benefit analyses.

- Detailed Calculation Models: For more complex projects, consider a more nuanced approach that includes scenario analysis, sensitivity analysis, or break-even calculations to give a comprehensive financial forecast.

The right calculation model allows stakeholders to evaluate the project’s potential through concrete numbers, giving them a clear view of when they can expect to see returns.

Step 6: Develop a Timeline and Success Metrics

A business case without a timeline and success metrics can appear vague, leading to a lack of accountability and follow-through. Including a roadmap with milestones and KPIs offers a clear path from project initiation to successful completion, reinforcing confidence in the feasibility of the proposal.

Consider the following:

- Key Milestones: Project initiation, key phases, completion dates.

- Performance Metrics: KPIs that align with the project’s objectives, such as cost savings achieved, efficiency improvements, or customer satisfaction scores.

- Break-Even Point: For larger projects, indicating the expected time to reach a break-even point can help justify initial investments.

By including these milestones and metrics, you ensure the project is positioned as achievable, trackable, and result-driven.

Step 7: Craft a Persuasive Executive Summary

Finally, a strong business case requires an executive summary that synthesizes the project’s purpose, potential impact, costs, and benefits in a concise, compelling way. This summary is often the only section senior stakeholders may read in detail, so it must be clear and convincing.

Your executive summary should:

- State the Problem: Explain the challenge or opportunity the project addresses.

- Highlight the Solution: Briefly outline how the proposed project will resolve this challenge or capitalize on the opportunity.

- Summarize Costs and Benefits: Provide a high-level overview of the financial investment and anticipated returns.

- Conclude with a Call to Action: Clearly state why the project is worth pursuing and the next steps for approval.

In Summary

Building a business case isn’t just about outlining potential benefits; it’s about creating a compelling, structured argument that aligns with the organization’s objectives and resonates with decision-makers. By following this framework—defining purpose, analyzing costs and benefits, structuring impacts, and providing a clear roadmap—you can increase the likelihood of gaining support and securing resources for your project.

A well-constructed business case can transform a good idea into a strategic initiative that drives value, growth, and success for your organization.

Go:lofty bonus content

1. What exactly is a business case, and why do I need one?

A business case is not just a financial spreadsheet. It is a structured argument that explains why your initiative matters, what outcomes it will deliver, and how risks will be managed. Upper management expects to see clarity of logic, not only ROI. A well-built business case becomes a decision-making tool: it aligns resources, sets expectations, and creates accountability. Without it, your proposal risks being seen as a request rather than an investment.

2. How do I calculate ROI in a way leadership will trust?

ROI credibility comes from transparency. Break down benefits into tangible (cost savings, revenue growth) and intangible (risk reduction, compliance, brand equity). Use conservative assumptions, cite industry benchmarks, and show sensitivity analysis—what happens if adoption is slower, or costs run higher. Executives are more likely to approve a case that is realistic but still attractive than one that is inflated and fragile.

3. How do I link the business case to corporate strategy?

Executives want to know: “Does this help us win where we compete?” Position your case in direct alignment with corporate priorities—market growth, innovation, digital transformation, sustainability. Instead of presenting the initiative as “nice to have,” frame it as a strategic enabler. Show explicitly how your project strengthens the organization’s ability to achieve long-term goals.

4. How do I get cross-departmental buy-in for my business case?

Engage stakeholders early, before the boardroom presentation. Share preliminary findings with finance, operations, marketing, and HR, and incorporate their perspectives. This co-creation approach makes your case stronger and prevents last-minute objections. In the final pitch, emphasize not just the benefits for your own department but how the initiative reduces pain points and creates value across the organization.

5. How do I quantify intangible benefits like customer experience or risk reduction?

Executives need numbers, but not every benefit has a direct revenue line. For customer experience, connect improvements to measurable metrics like retention rate, Net Promoter Score, or cost to serve. For risk reduction, quantify potential losses avoided (e.g., compliance fines, downtime costs). Where hard data is impossible, provide industry references or scenarios that translate intangible value into strategic impact.

6. How do I handle uncertainty in my assumptions?

Every business case contains uncertainty. The mistake is pretending it doesn’t. Executives respect leaders who openly discuss risk. Build in sensitivity analysis, offer a base case, best case, and worst case, and show how you would mitigate risks under each scenario. Position uncertainty as a reason to act now (e.g., secure market position early) rather than a reason to delay.

7. How do I make my business case stand out from competing priorities?

Executives are constantly weighing trade-offs. To rise above the noise, focus on three things: strategic alignment, financial impact, and timing. Demonstrate why acting now is critical (market window, regulatory deadline, competitor move). Then highlight why this initiative is not just another expense but a multiplier that improves the return on other ongoing investments.

8. What’s the best way to present a business case to upper management?

Think like the board: concise, visual, and strategic. Avoid 60-page decks. Instead, present a clear storyline: the problem, the opportunity, the solution, the economics, and the risks. Use a one-page executive summary supported by detailed appendices for those who want the data. Remember: upper management buys into the narrative of value creation, not just the numbers.

9. How do I ensure my business case actually gets implemented after approval?

A business case should include not only “why” but also “how.” Outline governance, milestones, and accountability. Identify an executive sponsor, a project leader, and the key metrics that will track progress. Upper management wants assurance that approval won’t lead to drift. A business case with built-in execution discipline is far more likely to be funded.

10. What’s the ROI of automating business case development itself?

Building cases is resource-intensive. Executives increasingly ask whether AI-enabled tools can help. The answer is yes: automation reduces wasted effort, validates financial scenarios faster, and improves consistency across proposals. Organizations that automate parts of the process (data gathering, benchmarking, ROI modeling) are able to evaluate opportunities more quickly, avoid duplication, and allocate resources to the most promising initiatives—ultimately leading to higher revenue, market share, and lower operational costs.